However, a financial plan may be created independently as well, as long as it is devoid of sentiments and is backed by data. It is so crucial that some high-net-worth individuals/families employ a financial firm or planner to help create one for them. It begins with where you are and creates a roadmap for where you want to be monetarily. What’s a financial plan?Ī financial plan is a comprehensive understanding and evaluation of your current financial state in comparison to your long-term goals, as well as the steps needed to achieve these set goals. It’s hard, if not impossible to create a personal financial plan without a budget but just before I go on with the benefits of budgeting, let me quickly explain what a financial plan is.

Why are budgets so important?īudgets are essential in helping you create a financial plan. They can be created by individuals or corporations and are usually short-termed to maximize efficiency.īudgets are not only for people who “know” or “ like” numbers, but can be as simple as you want.

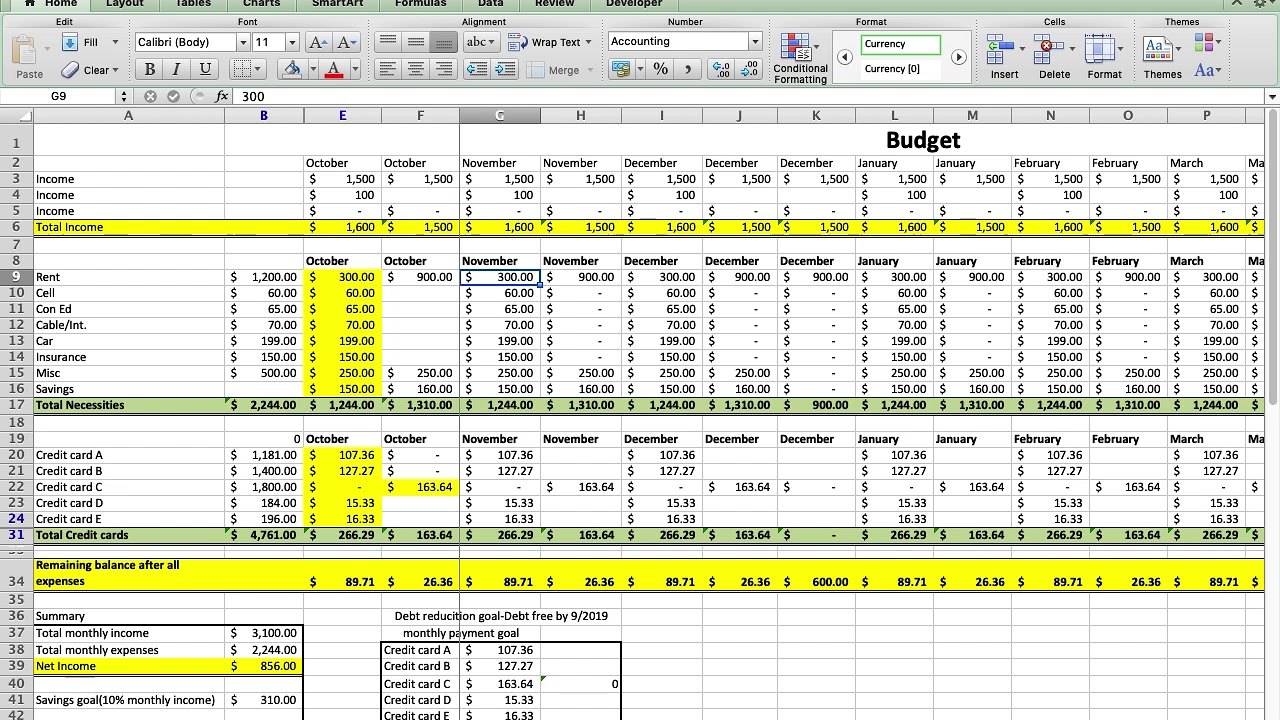

What is a budget?Ī budget is an approximation of one’s income and expenses for a set (future) period of time.Įffective budgets are evaluated periodically to eliminate spending assumptions and they help determine if one spends more or less than their income.īudgets are essential when measuring inflow vs outflow. This is one of the reasons people wake up at 50 sometimes and begin to ask “What did I use all my money for?” “What did I spend all my life doing?”Ī budget would have been a perfect way to answer that because data doesn’t lie. They were then able to block these money leaks – or at least drastically reduce them. However, one day, his wife asked him about all the money they were making and asked him to give an account but he became defensive – “I’ve spent most of the money on this family and you know it…”īut there was no budget, therefore, there was no way to show a corresponding expense list that showed that most of the money had been spent on the family for real.Īfter this, they created a budget (which includes an expense list) and found that a lot of the funds had actually been going to friends who wanted to borrow money and black tax (aka obligations or funds to assist family members). He started getting speaking engagements that paid more than he ever thought possible.

Ideally, you'd use this extra money to increase your savings, especially if you don't have an emergency fund. On the other hand, if you have more income leftover after listing your expenses, you can increase certain areas of your budget. It's a good idea to reduce these costs and regularly make adjustments to the amount of money you spend so you can avoid debt. This may include reevaluating how much you spend on groceries, household goods, streaming subscriptions and other flexible costs. You should review your variable expenses to find ways to cut costs in the amount of $300. If you notice that your expenses are higher than your income, you'll need to make some adjustments.įor instance, let's say your expenses cost $300 more than your monthly net pay. The last step in creating a budget is to compare your net income to your monthly expenses.

If you find that the average you spend on groceries each month is $433, you may want to round up and set the spending limit to $450. To calculate the average amount you spend on groceries, for example, add up all of your grocery spending during the past three months and divide by three. But fixed utilities, such as electric and gas, and variable costs, such as dining and household goods, often fluctuate month-to-month, so you'll need to do some math to find the average.įor these categories and any where you spending changes from month-to-month, determine the average monthly cost by looking at three months worth of spending. For example, debt repayment on a mortgage or auto loan will cost the same each month. You can look up your spending on bank and credit card statements.įixed expenses are easier to list on your budget than variable expenses since the cost is generally the same month-to-month. After you separate fixed and variable expenses, list how much you spend on each expense per month.

0 kommentar(er)

0 kommentar(er)